Category: Bookkeeping

Understanding these common pitfalls is crucial for maintaining the integrity of financial statements and ensuring that the reported figures convey the true economic reality of the bond investments. Calculate the bond’s issue price by discounting the bond’s future cash flows (interest and principal payments) back to present value using the effective interest rate. When it comes to accounting for bond investments, the method used to amortize the premium or discount can significantly impact the reported interest income and carrying value of the bond. The Effective Interest Method and the Straight-Line Method are two primary approaches used in this process, each with its own set of principles and implications for financial reporting.

Concept 56: Effective Interest Rate Method and Amortization of Bond Discounts/Premiums

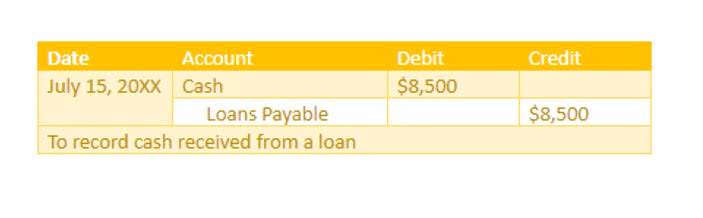

In our discussion of long-term debt amortization, we will examine both notes payable and bonds. While they have some structural differences, they are similar in the creation of their amortization documentation. An identical process is followed if the bonds are issued at a discount as the following example shows. It will contain the date, the account name and amount to be debited, and the account name and amount to be credited.

- For investors, they offer a predictable income stream and, depending on the bond’s rating, a relatively low-risk investment option.

- Bonds that do not have specific collateral and instead rely on the corporation’s general financial position are referred to as unsecured bonds or debentures.

- Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

- Understanding these nuances is key to making informed decisions in the bond market.

- It allows for a more informed decision-making process, taking into consideration the time value of money and the actual return on investment over the bond’s life.

Bond Amortization Schedule – Effective Interest Method

Assume that Discount Corp. issues 100, five-year, semi-annual, $1,000 bonds with an 8% coupon during a period of time when the market rate is 10% and so receives $92,278 because the coupon rate is lower than the market rate. When a consumer borrows money, she can expect to not only repay the amount borrowed, but also to pay interest on the amount borrowed. When retained earnings balance sheet she makes periodic loan payments that pay back the principal and interest over time with payments of equal amounts, these are considered fully amortized notes. After she has made her final payment, she no longer owes anything, and the loan is fully repaid, or amortized. Amortization is the process of separating the principal and interest in the loan payments over the life of a loan.

Impact of Market Rates on Bond Carrying Value

When the bond matures at the end of the 10th six-month period, the corporation must make the $100,000 principal payment to its bondholders. The when the effective interest rate method is used, the amortization of the bond premium market value of an existing bond will fluctuate with changes in the market interest rates and with changes in the financial condition of the corporation that issued the bond. For example, an existing bond that promises to pay 9% interest for the next 20 years will become less valuable if market interest rates rise to 10%. Likewise, a 9% bond will become more valuable if market interest rates decrease to 8%.

Discount on Bonds Payable with Straight-Line Amortization

Some bonds require the issuing corporation to deposit money into an account that is restricted for the payment of the bonds’ maturity amount. The restricted account is Bond Sinking Fund and it is reported in the long-term investment section of the balance sheet. It is reasonable that a bond promising to pay 9% interest will sell for less than its face value when the market is expecting to earn 10% interest.

The interest on carrying value is still the market rate times the carrying value. The difference in the two interest amounts is used to amortize the discount, but now the amortization of discount amount is added to the carrying value. Notice that the effect of this journal is to post the interest calculated in the bond amortization schedule (14,880) to the interest expense account. Notice that the effect of this journal is to post the interest calculated in the bond amortization schedule (10,363) to the interest expense account. Car Dealership Accounting In effect, because the bonds were issued at a premium and the business received more cash than the par value of the bonds, the cost (interest) to the business is reduced each period by the amount of the premium amortized.

First, let’s assume that a corporation issued a 9% $100,000 bond when the market interest rate was also 9% and therefore the bond sold for its face value of $100,000. An existing bond’s market value will decrease when the market interest rates increase.The reason is that an existing bond’s fixed interest payments are smaller than the interest payments now demanded by the market. Throughout our explanation of bonds payable we will use the term stated interest rate or stated rate. Usually a bond’s stated interest rate is fixed or locked-in for the life of the bond. When a bond fluctuates in price from its par value, it impacts the actual interest rate paid by the bond, known as the effective interest rate.

This formula is ideally used to identify the change from one quantity to the next available quantity, increasing by one output each time. However, it can also be used to identify average marginal revenue over a larger number of units, for example, the average increase per unit from 100 units to 150 units. From a firm’s perspective, a monopoly market structure provides an opportunity for high profits, which are further increased by price discrimination. A monopoly has only one firm dominating the market, while a monopolistic structure includes a few players selling close substitutes. A natural monopoly also addresses the question, “What is a monopoly in economics? ” This monopoly arises when a company expands production and experiences decreasing marginal costs across all levels of consumer demand—often due to substantial initial investments.

In this case, the marginal revenue of the 30th item would be $15, which is lower than the 20th item at $20. It shows that the marginal revenue of what is marginal revenue a perfectly-competitive firm is constant, and its marginal revenue curve is a horizontal line. Businesses use marginal revenue to determine the ideal quantity of goods to produce. Producing too many units can lead to diminishing returns, while producing too few units can result in missed revenue opportunities. Marginal revenue is subject to the law of diminishing returns, which states that any production increases will result in smaller increases in output.

Therefore, a positive marginal revenue corresponds to elastic demand, while a negative marginal revenue corresponds to inelastic demand. Marginal revenue helps companies understand the relationship between sales, market demand, and market competition. Additionally, growth and profitability come from understanding the intricate relationship between the two. Marginal revenue directly relates to total revenue because it measures the total revenue increase from selling an additional product unit. If the marginal revenue exceeds the marginal cost, then there are still residual profits attainable from greater production volume.

- Operating revenue is the core income generated from your primary business activities.

- Marginal revenue is one of many calculations that business leaders should use when scrutinizing the economic principles of their particular business model.

- In a competitive market, the price is set where the supply and demand curves meet.

- The market price of that last sale is most important for determining accurate MR.

- In this case, $10,200 – $10,000 equals $200, representing the additional income generated from selling one more unit.

Marginal Revenue Curve:

Selling extra units of a product or service leads to higher total revenue, marginal revenue, profitability, and additional costs. Therefore, it’s essential to understand marginal revenue because it measures revenue increment from selling more products and services. Marginal revenue is the net revenue a business earns by selling an additional unit of its product. On the other hand, average revenue refers to revenue earned per output unit.

Why does your business need to calculate marginal revenue?

Marginal revenue is the additional revenue generated from selling one more unit of a product or service. It is a key metric in economics and business that helps firms determine the optimal level of output and pricing. MR is derived from the total revenue curve and provides insight into how revenue changes with variations in sales volume. In a perfectly competitive market, marginal revenue equals the product price at all output levels.

Accounting software

Some small businesses, like sole traders, may use cash accounting, where revenue is recorded when payment is received, not when earned. Even though payment isn’t due until August, the revenue is recorded in July when the goods are delivered. This ensures that financial statements accurately reflect the business’s performance for the relevant period.

You can even see your customer segmentation, deeper insights about who your customers are, forecast into the future, and use automated tools to recover failed payments. Baremetrics provides an easy-to-read dashboard that gives you all the key metrics for your business, including MRR, ARR, LTV, total customers, and more directly in your Baremetrics dashboard. For example, if you head to an all-you-can-eat buffet, you pay to eat as much as you’d like. However, that third slice of chocolate cake is not going to add as much happiness as the first. You could say there is greater marginal benefit to eating the first slice of cake than eating the third slice of cake. Baremetrics is a business metrics tool that provides 26 metrics about your business, such as MRR, ARR, LTV, total customers, and more.

They charge the highest price that each customer group is willing to pay. The buyers with high demand elasticity would be charged relatively lower because the quantity they buy is susceptible to price changes. Those with inelastic demand curves must pay higher prices for the same products. A monopoly represents a distinct shift from perfect competition—marking a unique setup in market structures. Unlike the myriads of small firms in an ideal competition that compete for market share, what is a monopoly in economics? A monopoly is characterized by a single seller who dominates the market, setting prices and controlling supply.

Although marginal revenue can be constant over many units of output, the law of diminishing returns states that it will eventually decrease as the output level increases. When marginal costs equal marginal revenue, then the firm enjoys profit maximization. Past this point, the company cannot make any more profit since any additional production costs more. Economic theory states that perfectly competitive firms will continue to produce output until marginal revenue equals marginal cost.

Interpreting Results in Business Context

One would surely be able to fully understand marginal revenue only if one knew its formula, its examples, and how they relate graphically. Marginal revenue is the increase in revenue generated by the sale of one additional unit of a product or service. Though it can remain constant up to a certain point of output, marginal revenue follows the law of diminishing returns. This economic concept analyzes the profitability of selling more products. The purpose of this calculation is to perform some comparisons in order to evaluate a decision of increasing the number of units being sold.

Calculating Marginal Revenue Formula

Armed with this data, Apex Widgets adjusts its pricing strategy, balancing increased sales volume against reduced per-unit prices. Financial modeling and simulations help the company project scenarios, such as changing the discount rate or expanding the product’s geographic reach. These insights guide decisions about scaling production and marketing efforts, ensuring a calculated approach to revenue growth and profitability. For instance, if a company’s total revenue from selling 100 units is $10,000, and selling 101 units increases total revenue to $10,200, these figures are the basis for the calculation.

Where perfect competition is a battleground for numerous competitors, a monopoly sees one entity ruling the market. Understanding the concept of marginal revenue, marginal revenue formula, and their practical applications is essential for businesses aiming to make informed decisions that optimize profits. Marginal revenue is significant in economic theory because a profit maximising firm will produce up to the point where marginal revenue (MR) equals marginal cost (MC).

- Marginal revenue directly relates to total revenue because it measures the total revenue increase from selling an additional product unit.

- If the company produces units beyond that point, marginal costs will be higher than marginal revenue, which means a loss rather than a profit.

- The intersection at which this occurs is the point where the marginal benefit equals the marginal cost.

- To showcase how easy it is to use the MR formula, let’s imagine a business that sells tires.

- For instance, if a company’s total revenue from selling 100 units is $10,000, and selling 101 units increases total revenue to $10,200, these figures are the basis for the calculation.

To obtain average revenue, divide the total revenue earned from the number of units sold. Regardless of industry or type of good, marginal revenue can help a business determine its ideal level of production and activity. In conditions of imperfect competition, however, a business must lower its prices to sell additional units, so marginal and average revenue will not always be equivalent. The price changes as the number of units sold changes, so marginal revenue is lower with each additional unit and will be equal to or less than average revenue. In a perfectly competitive market, firms are price takers, and MR equals the market price.

Marginal Revenue and Marginal Cost

It’s also called sales or turnover and is the starting point for calculating profit. When a monopolist adopts single pricing, significant DWL occurs because customers with high demand elasticity purchase less. To understand how total profit shifts compared to single pricing, we must discuss deadweight loss (DWL). DWL arises from market inefficiencies when a uniform price is set for all customers—leading to revenue losses from excessively high prices. Marginal revenue along with marginal cost can help you understand how to price your product as well as how much to produce. However, these are just some of the many metrics needed by a modern SaaS enterprise to thrive in the competitive, global software market.

Marginal revenue is one of many ways you can analyze revenue data to uncover helpful insights for investors and businesses. Management, for instance, can use it to understand consumer demand, plan production schedules, and set product prices. Let’s take a closer look at the concept of marginal revenue and how you could make use. Businesses must maintain detailed sales records and financial statements to track total revenue at varying sales levels. These records should reflect all revenue, accounting for price variations or discounts. A clear record of the number of units sold at each price point ensures accurate ΔQ calculation.

Chief among them is using good bookkeeping software to keep track of the business’s finances throughout the year. Your bookkeeper can help you find ways to save on costs, reduce excess spending, and identify opportunities to invest in growing your business. We specialize in training companies to best utilize the right bookkeeping software and in developing business processes that help your entire team work more efficiently. We help you effortlessly maintain your books with user-friendly processes and even support your existing accounting software. This is the first step to achieve financial harmony for your business.

From our Clients

We work with small businesses to ensure that you bookkeeping are fully aware of where you stand in your finances on a monthly and yearly basis. You will have access to reports and data that will enable you to make better decisions for your business. Get a dedicated bookkeeper supported by a team of experts for a fraction of the cost.

Bookkeeping for Small Businesses

Your industry is unique, but so is your philosophy, your strategy, and every individual on your team. We understand every company faces unique challenges, and that extends to its finances. Outsourcing your small business accounting helps you save time, money, and increase profitability. It takes time Grocery Store Accounting to fine-tune your products, develop a winning team, implement a successful marketing campaign, and so on.

Fourlane implements QuickBooks bookkeeping best practices and training for internal operations at Net Friends

- We work with you to streamline your bookkeeping software to focus on the features you need while preventing the features you don’t use from being a distraction.

- You can use the pricing tool on the Bookkeeper360 website to test out all the pricing combinations for each plan.

- Our bookkeepers are fluent in these platforms, ensuring seamless integration and financial data management.

- Professional bookkeeping services help you produce useful reports to make decisions.

- Merritt will also work directly with your certified public accountant (CPA) to get the reports they require during tax season.

- Whether we are closely involved in your ongoing accounting needs or helping you customize or migrate your QuickBooks version, Fourlane knows the ins and outs of bookkeeping with QuickBooks.

If your goal is to grow your small business quickly, save money, and increase efficiency, our outsourced accounting solutions are perfect for you. Linda Rost’s BetterBookkeepers offers a wide array of remote bookkeeping services to cater to the diverse needs of small businesses. From daily transaction recording to bank reconciliations, QuickBooks training, and payroll management, we’ve got you covered. Our comprehensive service offerings ensure that you have Online Accounting access to all the bookkeeping support you need under one roof. Unlike do-it-yourself (DIY) bookkeeping services, 1-800Accountant provides dedicated bookkeeping and back bookkeeping services done-for-you (DFY).

Three Reasons To Love LYFE Accounting

Fourlane’s bookkeeping services are tailored to your specific business and industry. We’ve helped thousands of companies with our specialized services, customizing their software and settings, and even training them to get the most from their bookkeeping processes. We serve entrepreneurs and small businesses by ensuring their books are accurate – no shortcuts, no hassle. We give our clients peace of mind that it’s done and done right. We are a partner, coach and sounding board, and help our clients understand and use their numbers to make decisions for growing their dream businesses.

- Yes, small businesses use catch-up bookkeeping to get their books up to date.

- By providing real-time insights into your cash flow and financial performance, this software enables small businesses to make informed decisions, improve efficiency, and focus more on growth and strategy.

- Hiring a small business bookkeeping service provider is often more cost-effective than employing an in-house bookkeeper.

- Make the most strategic choices about hiring, equipment upgrades, and reduced spending with the assistance of our expert custom bookkeeping services.

- Bookkeeper.com offers business owners a full range of bookkeeping services—including virtual bookkeeping and accounting, tax preparation and planning, financial planning and investment, as well as payroll.

- The goal of CFO services for small businesses is to make sure you are profitable.

The first plan, Support, is geared toward businesses who want to continue to manage their own bookkeeping, with some assistance from the Bookkeeper360 advisors. At $199 per month, this plan includes two hours per month of support as well as training and check-ins from the Bookkeeper360 team. However, Wave will likely fall short for more complex small businesses, especially those planning to scale. It does not offer time, project, or inventory tracking, and its automatic transaction data requires a bit of manual maintenance to keep it accurate. For small business owners, tax time will never be easy, per se, but there are ways to make it less painful.

Table 2, Part B, reflects the member’s share of nonbusiness income from real and tangible property wholly sourced or allocable to California. This is added to apportioned business income and nonbusiness intangible income allocated to California and becomes a part of California taxable income. Portfolio income (loss), referred to as “portfolio” income (loss) in these instructions, is generally not subject to the passive activity limitations of IRC Section 469. Portfolio income includes interest, dividend, royalty income and gain or loss on the sale of property held for investment. Generally, amounts reported on line 8, line 9, and line 11a, are gains or losses attributable to the disposition of property held for investment and are, therefore, classified as portfolio income (loss). However, if an amount reported on line 8, line 9, or line 11a, column (d), is a passive activity amount, the LLC should identify the amount.

Line 22 – More than one activity for passive activity purposes

Amounts entered on this line are the deductions that are clearly and directly allocable to portfolio income (other than investment interest expense and expenses from a REMIC). If you have an amount on Schedule K-1 (568), line 13e, column (c), enter this amount on Schedule CA (540), Part II, line 21 or on Schedule CA (540NR), Part III, line 21. If any of the line 13e amounts should not be reported on Schedule CA (540 or 540NR), the LLC should identify these amounts. The LLC will provide information on your share of the IRC Section 179 deduction and of the cost of the LLC’s IRC Section 179 property so that you can compute this limitation. Your IRC Section 179 deduction is also limited to your taxable income from all of your trades or businesses.

Line 11a – Other Portfolio Income (Loss)

The LLC will complete Table 2, Parts A to C for unitary members and Table 2, Part C for all non-unitary members. Table 2 does not need to be completed for non-unitary individuals. If you have an amount on Schedule K-1 (568), line 6, column (c), report this amount on Schedule CA (540), Part I, Section A, line 3, or on Schedule CA (540NR), Part II, Section A, line 3, column B or column C, whichever is applicable.

Questions and Items

- The different items of business income as apportioned to CA are entered in column (e).

- If applicable, the LLC will attach a schedule for line 2 to identify such amounts.

- Use these amounts, if any, to adjust line 20a and line 20b to determine your total investment income and total investment expenses from this LLC.

- When the partnership has more than one activity for at-risk purposes, it will check this box and attach a statement.

- However, do not combine the prior-year amounts with any amounts shown on this Schedule K-1 (568) to get a net figure.

- Federal and California law allows spouses that are the sole owners of an eligible business entity (including an LLC) to be treated as two owners or one owner, for purposes of applying rules to determine the classification of that entity for tax purposes.

If there is an amount on Schedule K-1 (568), line 4c, Total guaranteed payments, column (c), enter this amount on Schedule CA (540), Part I, Section B, line 8z, or on Schedule CA (540NR), Part II, Section B, line 8z, column B or column C, whichever is applicable. If this is a passive activity for the member, then the member must also complete the passive activity form. Use federal Form 8582, Passive Activity Loss Limitations, for federal purposes and form FTB 3801 for California purposes. K – Beginning in taxable year 2021, all LLCs must report members’ capital accounts using the tax basis method on California Schedule K-1 (568). Current year net income/loss and other increases/decreases are now separately reported in columns (c) and (d), respectively. For more information on partner tax basis capital account, get the Partner’s Instructions for federal Schedule K-1 (Form 1065).

Inconsistent Treatment of Items

California does not conform to the deduction for qualified business income of pass-through entities under IRC Section 199A. The income data contained in Table 1 is not reflected in column (e) of Schedule K-1 (568) because the source of such income must be determined at the member level. The member must make a determination whether the nonbusiness intangible income is from a California source. When the partnership has more than one activity for at-risk purposes, it will check this box and attach a statement. For more information, get the instructions for federal Schedule K-1 (Form 1065), line 22.

- Combine these totals with investment income and expenses from all other sources to determine the amount to enter on form FTB 3526, line 1.

- If you have credits that are passive activity credits, complete form FTB 3801-CR (corporations use form FTB 3802), in addition to the credit forms referenced.

- You cannot claim the low-income housing credit on any qualified low‑income housing project for which any person was allowed any benefit under Section 502 of the federal Tax Reform Act of 1986.

- The member must determine the source of such income by applying the rules described above.

- I – If you have contributed property with a built-in gain or loss during the tax year, the Limited Liability Company will check the “Yes” box and will attach a statement.

The LLC can include on line 15f your distributive share of net income taxes paid to other states by the LLC. Subject to the limitations of R&TC Section 18006, members may claim a credit against their individual tax for net income taxes paid by the LLC to another state. The amount of tax paid is required to be supported by a copy of the return filed with the other state and evidence of the payment of the tax. This line is used to report information you need to compute pass- through credits and other items that are not includable on line 15a through line 15d but are related to the trade or business activity. The LLC should provide a schedule and/or statement explaining any items.

Line 18a through Line 18c – Tax-exempt Income and Nondeductible Expenses

- K – Beginning in taxable year 2021, all LLCs must report members’ capital accounts using the tax basis method on California Schedule K-1 (568).

- Information from the Schedule K‑1 (568) should be used to complete your California tax return.

- For more information, see the instructions for federal Schedule K-1 (Form 1065).

- Portfolio income includes interest, dividend, royalty income and gain or loss on the sale of property held for investment.

- For more information about unitary business principles, get FTB Pub.

- Portfolio income (loss), referred to as “portfolio” income (loss) in these instructions, is generally not subject to the passive activity limitations of IRC Section 469.

For more information about unitary business principles, get FTB Pub. The member’s share of the LLC’s business income is entered on Table 2, Part A. recording transactions The member then adds that income to its own business income and apportions the combined business income using the revised factor described below. If the LLC paid or accrued interest debts it incurred to buy or hold investment property, the amount of interest you can deduct may be limited. For more information and the special provisions that apply to investment interest expense, get form FTB 3526, Investment Interest Expense Deduction, and federal Pub. The LLC will provide a schedule that shows which contributions were subject to the 50 percent, 30 percent, and 20 percent limitations.

The Bookkeeping for Veterinarians Franchise Tax Board (FTB) uses information from form FTB 4197 for reports required by the California Legislature. However, the passive activity credit limitations of IRC Section 469 may limit the amount of credit. Credits from passive activities are generally limited to tax attributable to passive activities. If, in addition to this passive activity income, you have a passive activity loss from this LLC or from any other source, report the income on form FTB 3801 or form FTB 3802.

For example, if the risk of material misstatement is high, auditors need to reduce the level of detection risk. Detection risk is the risk that auditors fail to detect material misstatements that exist on the financial statements. In that case, the auditor may need to perform more extensive audit procedures.

Reconciliation Data Sheet

Sometimes, that nature of business could link to the complexity of financial transactions and require high involvement with judgment. Acceptable audit risk is the amount of risk an auditor will take when giving a “clean” report. A “clean” report means the auditor believes the controls are accurate and free of significant errors. For example, meeting compliance standards like HIPAA or GDPR may have higher inherent risks due to their strict requirements and complex measures. A higher inherent risk indicates a greater chance of failing to meet compliance obligations. This article explores the core meaning of ARM, the types of risks incorporated within it, the formula used for calculation, a Bookkeeping for Painters cybersecurity audit risk example, and how it differs from audit assurance.

Control Risks:

At the time of planning, auditors should set the right audit strategy, employed the right audit approach, and have a strong strategic audit plan. For example, if audit planning is poor, not all kinds of risks are defined, and the audit program used to detect those risks is deployed incorrectly. Once the internal financial statements and risks are properly assessed, the audit programs audit risk model are properly tailored, then Control Risks are minimized.

Control risk

The ultimate goal is to obtain sufficient and appropriate audit evidence to support the auditor’s opinion on the fairness of the financial statements. Detection risk is the risk that audit evidence for any given audit assertion will fail to capture material misstatements. If the client shows a high detection risk, the auditor will likely be able to detect any material errors. In order to reduce the complexity of minimizing audit risk, auditors utilize a suite of sophisticated tools designed to enhance the precision and reliability of their work. These tools are not just efficiency enablers; they are crucial in deepening the auditor’s understanding of the financial landscape they navigate, ensuring that no stone is left unturned in the quest to validate financial statements.

- AuditBoard is the leading cloud-based platform transforming audit, risk, ESG, and InfoSec management.

- Inherent risk is also more likely when the transactions in which a client engages are highly complex, and so are more likely to be completed or recorded incorrectly.

- Examples of other people that an auditor might ask about fraud risks include the chief ethics officer, in-house legal counsel, and employees involved in processing complex or unusual transactions.

- In this case, auditors will not perform the test of controls on the bank reconciliation.

- The concept of audit risk is of key importance to the audit process and F8 students are required to have a good understanding of what audit risk is, and why it is so important.

- Detection risk is the risk that the auditor fails to detect the material misstatement in the financial statements and then issued an incorrect opinion to the audited financial statements.

Limitations of Audit of Financial Statements

In other words, the material misstatements of financial statements fail to identify or detect by auditors. Auditors can manage detection risk by carefully planning the scope, timing, and depth of their unearned revenue processes and evident collection so that any material misstatements are identified and addressed early on. It occurs when an auditor’s testing and procedures fail to uncover material non-compliance. A high detection risk score means that errors are more likely to be found during an audit, so the auditor suggests less rigorous control testing. These are the most common types and refer to the likelihood that an organization’s internal controls fail to detect or prevent non-compliance. For example, if an audit requires a low detection risk to counter a high control risk, auditors may rely less on control testing and conduct extensive substantive procedures to form a valid audit opinion.